We already know that Asia is a significant growth driver in e-commerce. In the last years, some countries from Southeast Asia have been showing a considerable number and gaining attention from investors all over the world as an excellent opportunity to expand their businesses.

Between now and 2026, the Southeast Asian market is projected to triple at a compound growth rate of 22 percent and will reach around $230 billion in gross merchandise volume.

While the pandemic has been a driving force, the fact that SEA has been a highly digitized region, to begin with, plays a significant role. In the six largest economies — Thailand, Malaysia, Singapore, Indonesia, Vietnam, and the Philippines — 70% of the population is online.

Local alternative payment methods can be an excellent strategy to land and succeed in this growing-fast economy.

Let’s take a closer look at two countries in particular — Indonesia and Malaysia.

Indonesia: consumers in Indonesia use an average of 3.16 e-wallets.

There is no question; e-wallets are booming across Asia, particularly in Indonesia. In Indonesia alone, transaction values rose by over 200 percent in 2019, and the country is home to almost 50 digital wallet players vying for customers. The e-wallet transaction value grew 334% in the last three years, reaching US$28 B.

It is forecasted that Indonesia’s total e-commerce transactions will reach US$137.5 billion by 2025 - the highest in the Asia Pacific region - representing 59% of its accumulated transaction value. E-commerce revenue will also increase to US$56.4 billion in the same year.

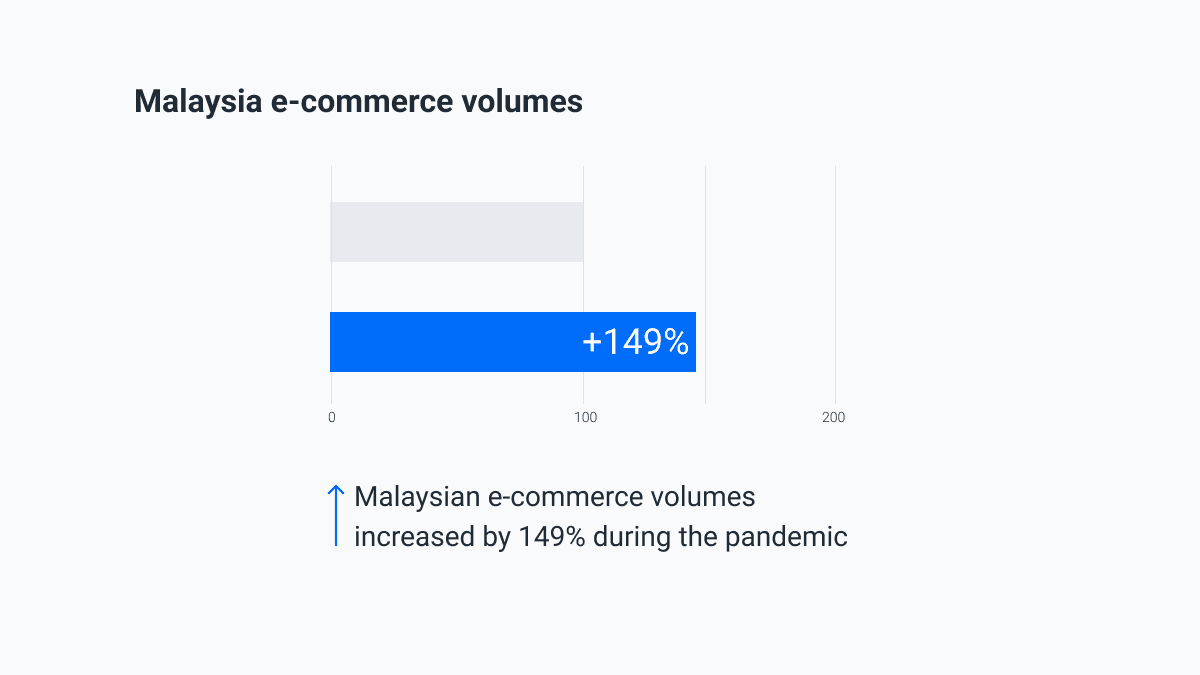

Malaysia: bank transfer apps are the favorite alternative payment methods.

During the first months of the pandemic, Malaysian e-commerce volumes increased by 149%. Now, nearly half of the online purchases in Malaysia are made through bank transfer apps, making that payment option the most popular payment option for online purchases, followed by credit cards and cash. Some e-wallets Malaysia loves using are Boost, GrabPay, Touch n Go, Financial Process Exchange, and FPX.

How it all adds up

It’s no surprise that different countries’ populations, like in Latin America and Africa, have unique buying habits and preferences. New players in the payment ecosystem, such as e-wallets and cards, are gaining a share in the payment mix pie while coexisting with traditional methods like cash, cards, and other alternative payment methods to reach the vast majority of the e-shoppers.

Indonesia and Malaysia are riding a new wave of regional growth. It is certainly attracting all eyes at the moment, and dLocal Go can help you expand your business to these countries with a simple and accurate payment platform.

With dLocal Go, your company can expand, take advantage of these new opportunities and offer local payments to your customers worldwide.

Are you ready to expand your business? Learn more about dLocal Go's solution and start your global expansion right now.