Let's GO to Africa! New Business Opportunities in Nigeria and Kenya

After helping SMBs to reach new customers all over Latin America, dLocal Go is heading new business opportunities in Africa: it's time to go to Nigeria and Kenya.

We are now offering our payment solutions to merchants worldwide who want to enter those two flourishing economies and are also ready to help SMBs in Nigeria and Kenya to sell locally and abroad with a state-of-the-art payment gateway.

So let's dive a little deeper into the second and third-largest economies in South Africa.

Nigeria, One Of The Most Developed Digital Economies in Africa

Nigeria has over 200 million people, and most of them are unbaked. The lack of access has led to the development of alternative ways to include this massive population in the digital world.

Due to this scenario, e-commerce is a growing market in the country's digital economy. Nigeria has a large and increasing middle class, which is adopting online shopping to access a wider range of products and services locally and abroad.

Digital commerce in Nigeria is the largest segment in the country, and it is expected to reach USD14.48bn of transaction value by the end of 2023.

2023 is expected to be a great year for Nigeria's economy, with another impressive number to come: digital payments in the country are expected to reach over USD16bn.

With an unbaked population and massive growth in the digital landscape, Nigerians have come up with several smart alternatives to the lack of traditional growing methods.

One good example of this innovation scenario is the extension of agency banking across Africa. Agency banking is a branchless banking that allows traditional banks to extend their network of branches and services cost-efficiently through authorized agents, who often operate through Points of Sale (PoS) terminals.

The Nigerian Inter-Bank Settlement System (NIBSS) reports that the value of transactions on Point of Sales (PoS) terminals across Nigeria rose by ₦1.05 trillion (USD2.3bn) from ₦3.56 trillion in the first seven months of 2021 to ₦4.61 trillion in 2022.

In such fertile ground, the number of Medium and Small Enterprises in Nigeria is impressive: close to 1.3 million, showing that Nigerians have a strong entrepreneurial spirit.

Numbers show business opportunities to companies that want to expand to Africa and local companies that aim to grow their business locally.

Kenya and The Boom of Mobile Money

Mobile money has gained a significant role in economies worldwide during the pandemic. But actually, the pandemic just highlighted a customer behavior that was about to boom: digitization.

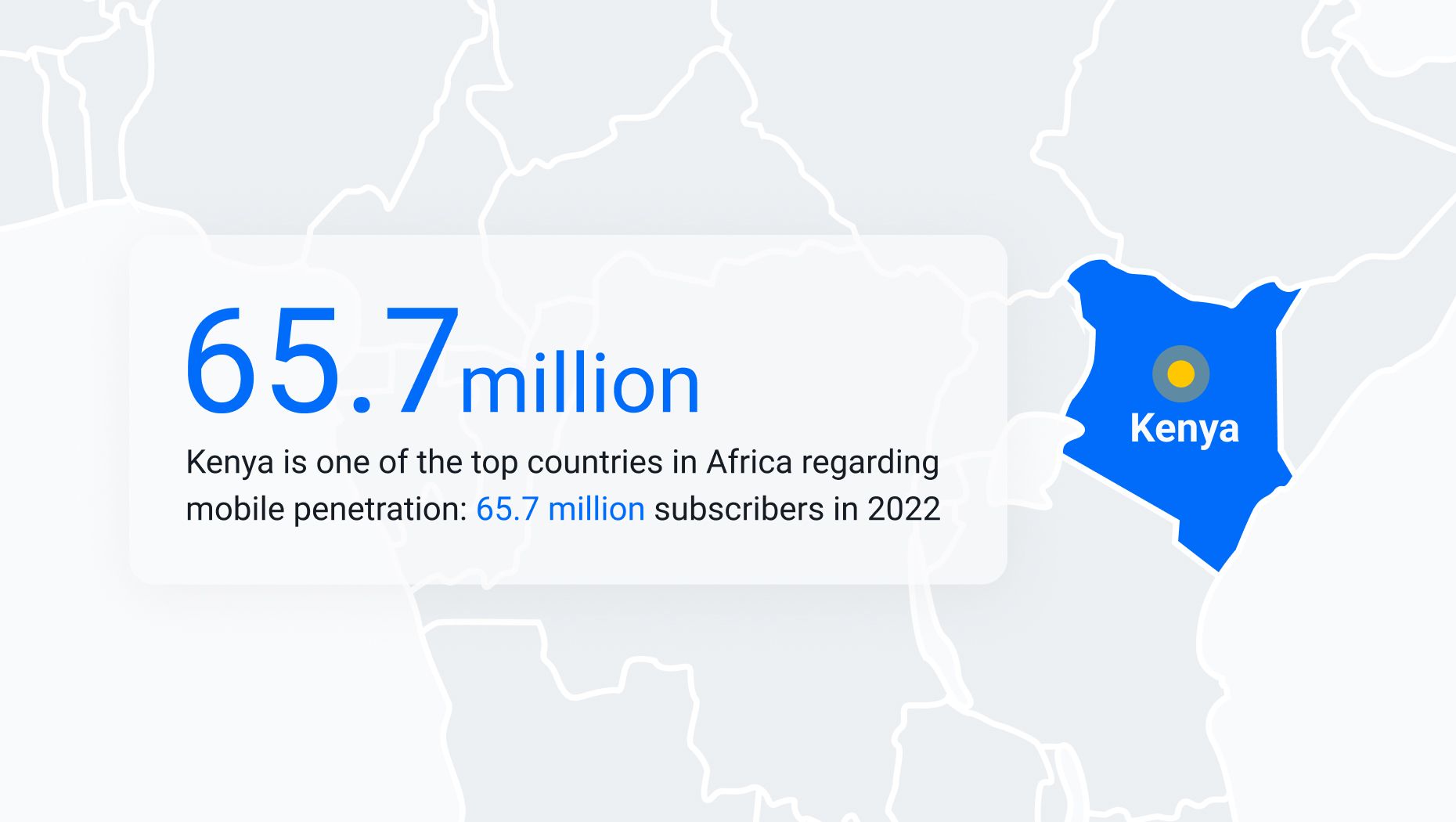

Mobile money is one of the key drivers of Kenya's digital economy. Kenya is one of the top countries in Africa regarding mobile penetration, with more than 65.7 million subscribers in 2022, according to Business Insider. Considering that Kenya has a population of approximately 55 million people, according to The World Bank, this shows that Kenyans have more than one phone.

This scenario has led to the emergence of a range of digital services, especially mobile money. Mobile money platforms like M-Pesa, MFS, and Cellulant have become popular, and there has been significant growth in the use of digital payments in recent years.

Those numbers have impacted not only the way Kenyans pay but also the way they relate to their gainings. According to the State of the Industry Report on Mobile Money 2023, 27% of salary payments in Kenya were received via mobile money.

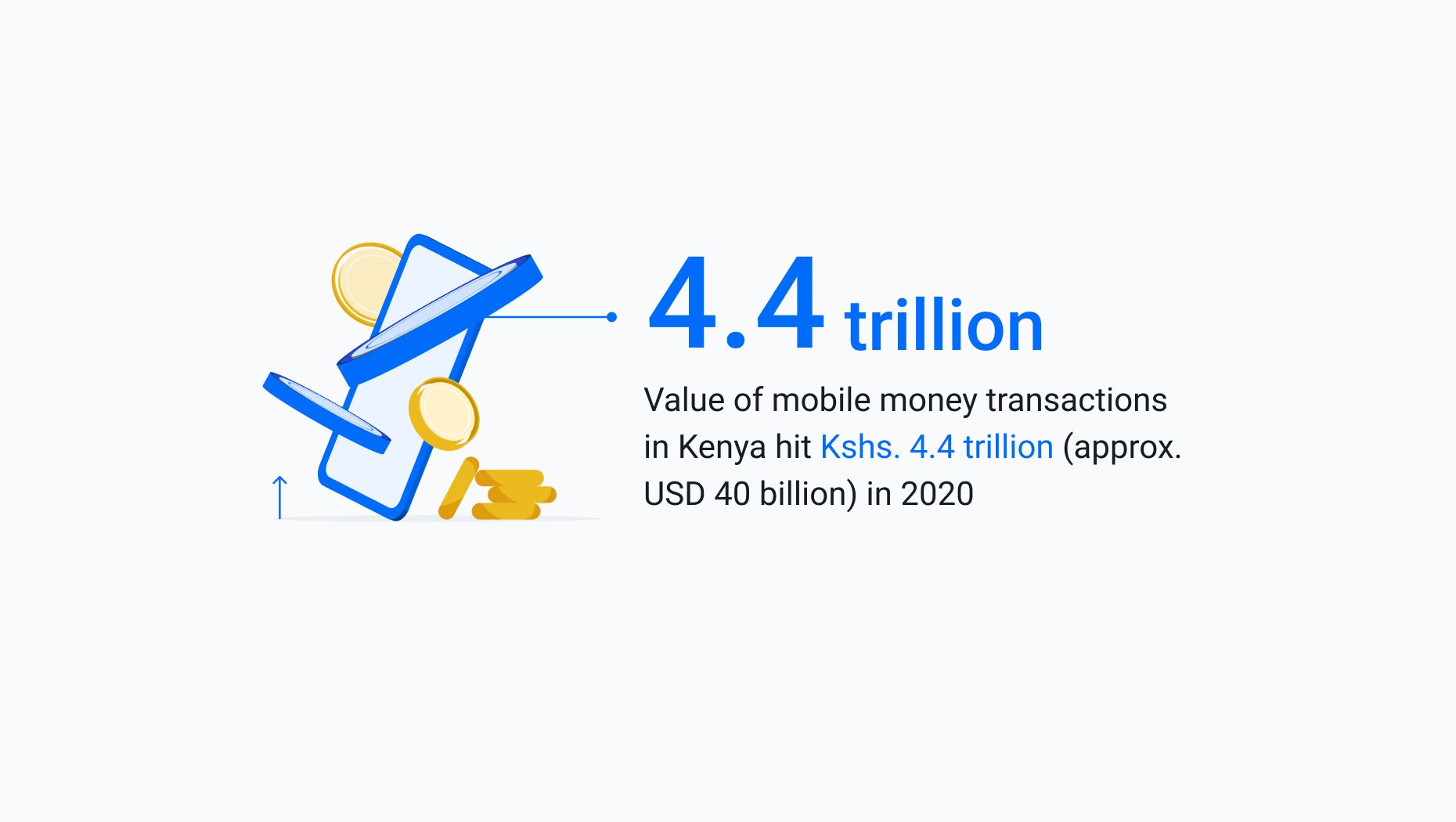

According to the Central Bank of Kenya, the value of mobile money transactions in Kenya hit Kshs. 4.4 trillion (approx. USD 40 billion) in 2020. And the market size is expected to reach USD 348.3 billion by 2028, according to IMARC Group.

Kenya's digital economy presents significant opportunities for investors and local entrepreneurs. However, there are also challenges to be addressed, such as infrastructure development, digital literacy, and regulatory frameworks, to realize the potential of Kenya's digital economy fully.

That's why counting on the right payment partner is so important to business expansion, locally and globally

dLocal Go can help SMBs from all over the world that want to enter the flourishing digital economy in Nigeria and Kenya and also help local medium businesses to create a better payment network in their own market.

You can offer a range of local payment methods with dLocal Go to reach even more customers, including credit cards, bank transfers, and mobile money.

Get to know our solutions and start to expand your business with us right now: https://dlocalgo.com/en/coverage