What are alternative payment methods?

APMs (Alternative Payment Methods) refer to any form of payment that isn’t a major international credit card brand.

Domestic cards, cash-based vouchers such as Boleto in Brazil or Oxxo in Mexico, mobile payments, digital wallets — such as Apple Pay and Google Pay — or local bank transfers, such as PIX in Brazil, are all considered alternative payment methods.

Whether you have an e-commerce or an offline business, offering alternative payment methods can increase your company's growth and awareness. These payment options are rising worldwide and promoting access to physical and digital goods, especially in the fastest-growing markets such as Latin America, Africa, and Asia.

If you want to expand your business and increase your sales, check out our eight reasons why alternative payment methods can make a difference in your company.

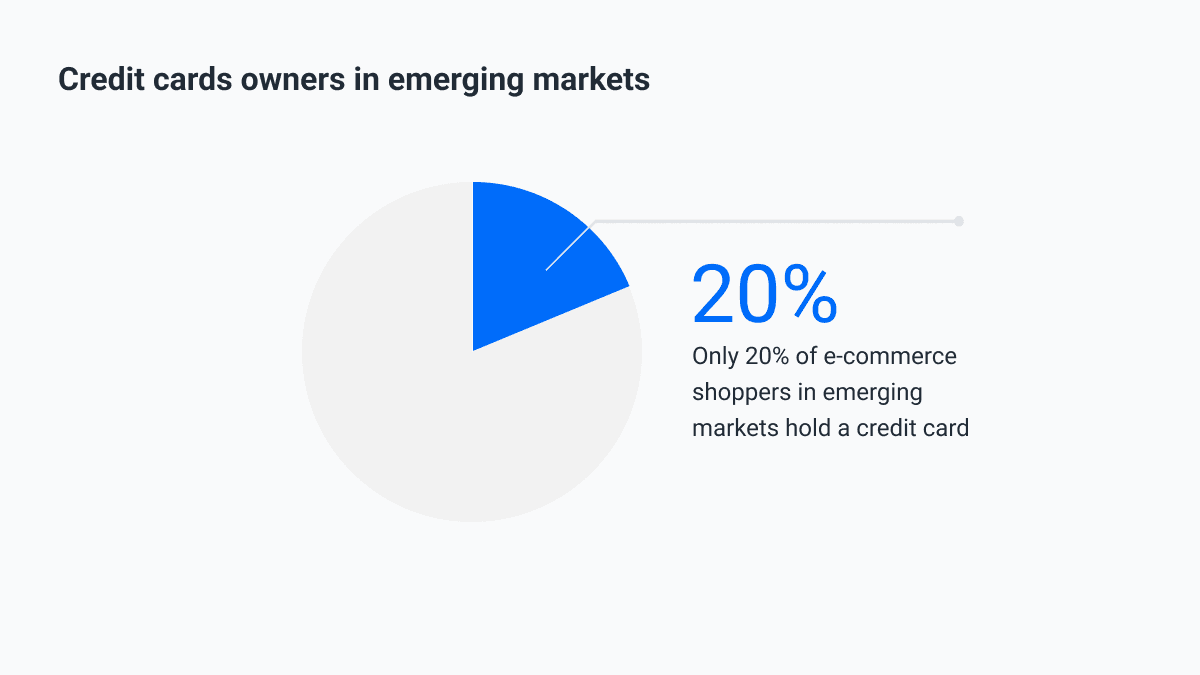

1. Credit cards are not accessible to everybody

While credit and debit card penetration is widespread in countries such as the United States and Canada, where 55% of all payments in 2020 were made with credit and debit cards, the situation is different in emerging countries.

Only 20% of e-commerce shoppers in emerging markets hold a credit card. Credit card penetration in these markets is mainly slow due to various reasons, such as a lack of accessibility and consumer confidence, alongside concern over card fraud. However, smartphone penetration is way higher, reaching 70% or up to 80% in countries like Argentina, Mexico, and Brazil.

2. The boom of digital payments during Covid

During the pandemic, digital payments went through massive adoption, especially in emerging markets. According to The World Findex Data Base 2021 released by The World Bank, 64% of adult consumers purchased or received money from a digital payment network. When we look at emerging economies, the number of adults receiving or making digital payments grew from 35% in 2014 to 57% in 2021: an increase of 22%.

In addition to that, the growth of digital payments surpasses the growth of account owners in emerging markets, according to The World Bank's latest report.

3. APMs are inclusive and diverse

Preference varies from country to country, and it's integral to identify which countries use what when trying to enter a market.

In November 2020, Brazil, Latin America’s largest online market, launched Pix, an instant payment solution. Within only two years, Pix has been a big success in Brazil, being the most used payment method in the country, having moved R$12,9 trillion since its launch.

In Colombia, the success of PSE (Pagos Seguros en Línea) is also huge, achieving 25% of growth in 2022 compared to the previous year.

As technology advances and APMs become more commonplace, identifying a payment gateway that can cover the popular options across different regions is rapidly becoming necessary for businesses.

4. Not having customers' preferred payment method kills conversion

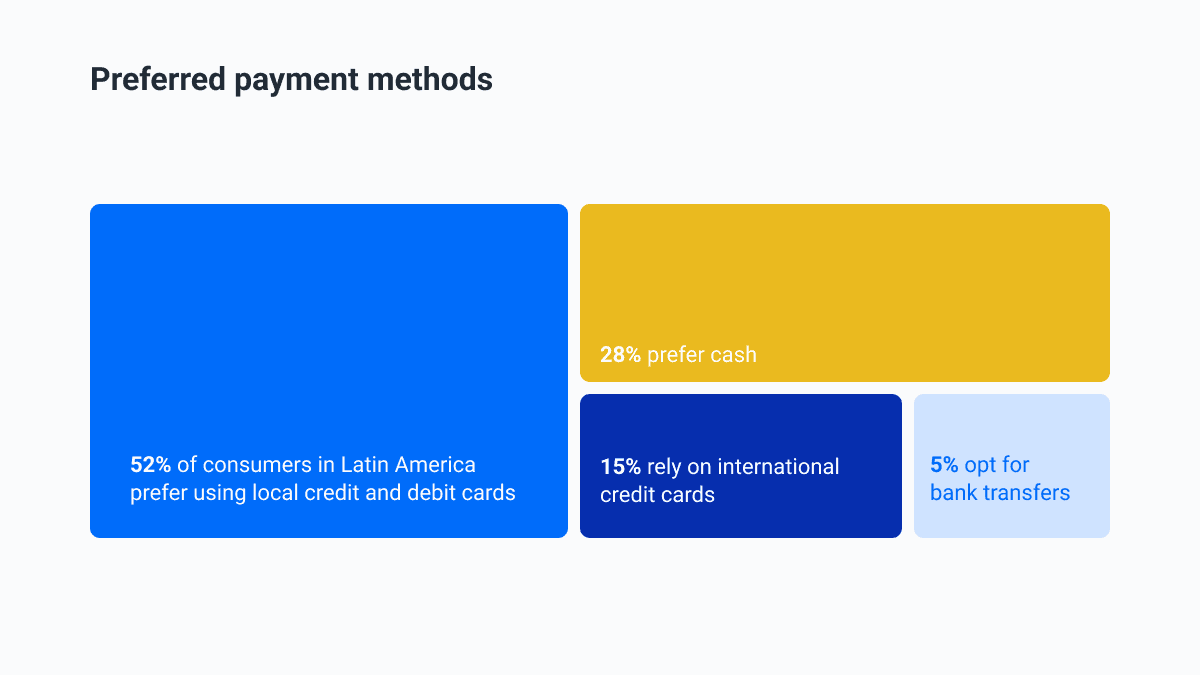

An Oxford Economics research showed that 56% of consumers said that if they couldn’t use their payment method, it would permanently put them off shopping on a site. On this matter, 52% of consumers in Latin America prefer using local credit and debit cards, 28% prefer cash, 15% rely on international credit cards, and 5% opt for bank transfers.

Know your customers and their payment preferences to boost your payment acceptance rates.

5. User experience is the key to e-commerce

Offering a good user experience is essential to create a good relationship with your customers, which also extends to payment methods.

Whether your client is paying with credit cards, cash, installments, or any other preferred payment method, the user experience must be good. A recent research made by Baymard Institute shows that 17% of customers left their carts on online commerce because the checkout process was too long or complicated.

The localized, unique user experience comes from the alternative payment methods offering customers familiar payment solutions, making e-commerce available to everyone, regardless of their access to banking services.

6. Be global and local at the same time

Being a global company in an emerging economy does not mean you cannot understand your customer. In emerging markets, APM is often synonymous with local knowledge. Local merchants are typically offering local card-based checkout options and a plethora of APMs, such as mobile money, e-wallets, cash-based solutions, QR codes, or SMS-powered local payment methods.

If you come in with these highly localized solutions, not only will consumers perceive familiarity with your brand and find it in sync with local habits, but it will give you the same edge as a local company in terms of market reach and profitability potential.

7. Build trust and brand awareness

Offering transaction methods that customers are familiar with build trust, user experience, and reliability while providing a frictionless process that minimizes cart abandonment. In 2020, Invesp had the global average shopping cart abandonment rate at 65.23%, with Asia and Latin America as two regions with some of the highest abandonment rates.

While there are various cumulative reasons for this, a lack of alternative payment methods and experiencing frustration along the payment process can cause cart abandonment.

8. Increase sales conversion

According to Baymard Institute, a good customer experience can raise conversion rates to 400%. Alternative Payment Methods have already proved their value in providing a better customer experience and a broader payment acceptance which are good strategies to grow sales conversation.

Investing in APMs can be a growth driver for your company

Emerging markets are a dormant demand that alternative payments can help you to reach. As these markets develop and grow, so will their payment options and preferences.

Learn more about alternative payment methods and how to offer them to your customers, or contact us to understand your company's options.